Getting Started with Payments

Maraboo's payment system enables you to send and receive funds across multiple currencies and payment channels. This guide covers the fundamentals of working with payments in the Maraboo ecosystem.

Payment Types

Maraboo supports several types of payment operations:

1. Deposit Transactions

Add funds to your wallet from external sources.

- Use case: Fund your Maraboo wallet to enable payments

- Payment methods: Interac, bank transfers, mobile money

- Endpoint:

POST /api-access/transactions/client/sessions/deposit

2. Payment Transactions

Send funds to recipients (individuals or businesses).

- Use case: Pay suppliers, send money to individuals

- Payment channels: Mobile money, bank transfers, Interac

- Supports: Multiple currencies (XOF, CAD, etc.)

- Endpoint:

POST /api-access/transactions/client/sessions/payment

3. Withdrawal Transactions

Transfer funds from your wallet to your own pre-configured accounts.

- Use case: Move funds to your bank account

- Methods: EFT, ACH, Interac

- Endpoint:

POST /api-access/transactions/client/sessions/withdrawal

Learn more about withdrawals →

4. Swap Transactions

Exchange currency between wallets or swap and send to recipients.

- Swap types:

- SWAP: Currency exchange between your own wallets

- SWAP_SEND: Exchange currency and send to a recipient in one transaction

- Endpoint:

POST /api-access/transactions/client/sessions/swap

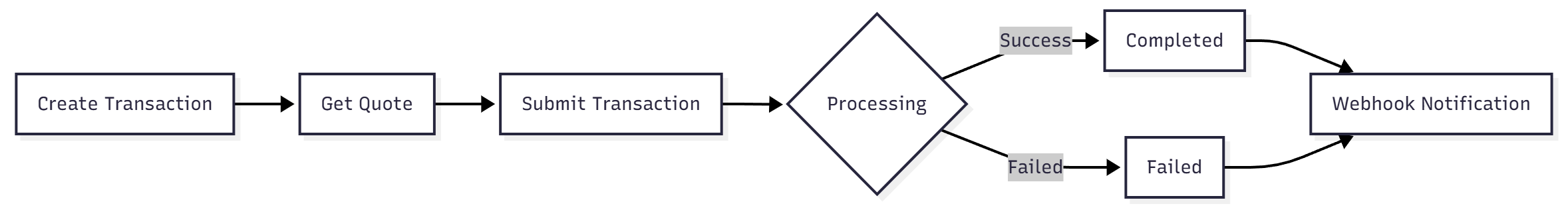

Payment Lifecycle

Understanding the payment lifecycle helps you track and manage transactions effectively.

Transaction Statuses

| Status | Description |

|---|---|

pending | Transaction has been created and is awaiting processing |

processing | Transaction is being processed by the payment provider |

completed | Transaction has been successfully completed |

failed | Transaction has failed (see failure_reason for details) |

Typical Payment Flow

- Get a Quote: Use calculator endpoints to get exchange rates and fees

- Create Transaction: Submit transaction with quote ID

- Track Status: Monitor transaction status via webhooks or polling

- Handle Result: Process completion or handle failures

Before You Start

Prerequisites

Before making payment transactions, ensure you have:

- Active Maraboo Account: Sign up at the Maraboo portal

- API Credentials: Generate your Public and Private keys

- Funded Wallet: For payment and withdrawal transactions

- Recipient Information: Valid recipient details for payments

Authentication

All payment endpoints require HMAC-SHA256 authentication:

Authorization: HMAC-SHA256 PUBLIC_KEY:PRIVATE_KEY

X-Origin: third-party-api.mara.boo

X-Timestamp: 2025-10-12T14:30:00.000Z

X-Idempotency-Key: unique-transaction-id

Content-Type: application/jsonRequired Headers:

Authorization: HMAC-SHA256 authenticationX-Origin: Must bethird-party-api.mara.booX-Timestamp: Current timestamp in ISO 8601 formatX-Idempotency-Key: Unique identifier to prevent duplicate transactionsContent-Type: Must beapplication/json

Learn more about authentication →Learn more about idempotency →

Payment Calculators

Before creating transactions, use calculator endpoints to get accurate quotes:

| Calculator | Purpose | Endpoint |

|---|---|---|

| Deposit Calculator | Calculate deposit fees and amounts | POST /api-access/calculators/deposit |

| Payment Calculator | Get payment quotes with fees | POST /api-access/calculators/payment |

| Swap Calculator | Calculate currency exchange rates | POST /api-access/calculators/swap |

| Swap and Send Calculator | Quote for swap + payment | POST /api-access/calculators/swap-send |

Common Payment Patterns

Pattern 1: Simple Payment

// 1. Get a quote

const quoteResponse = await fetch('https://sandbox-gateway.mara.boo/api-access/calculators/payment', {

method: 'POST',

headers: { /* auth headers */ },

body: JSON.stringify({

amount: 5000,

country: 'bj',

channel: 'mobile_money',

currency: 'xof'

})

});

const { quote_id } = await quoteResponse.json();

// 2. Create payment

const paymentResponse = await fetch('https://sandbox-gateway.mara.boo/api-access/transactions/client/sessions/payment', {

method: 'POST',

headers: {

'Authorization': 'HMAC-SHA256 YOUR_PUBLIC_KEY:YOUR_PRIVATE_KEY',

'X-Origin': 'third-party-api.mara.boo',

'X-Timestamp': new Date().toISOString(),

'X-Idempotency-Key': `payment-${Date.now()}-${quote_id}`,

'Content-Type': 'application/json'

},

body: JSON.stringify({

quote_id: quote_id,

wallet_id: 'wallet-456',

transaction: {

amount: 5000,

country: 'bj',

channel: 'mobile_money',

currency: 'xof'

},

recipient: {

first_name: 'John',

last_name: 'Doe',

phone: '+22997123456',

country: 'bj',

transaction_type: 'mobile_money',

provider: 'mtn',

currency: 'xof'

}

})

});Pattern 2: Currency Swap

// 1. Get swap quote

const swapQuote = await fetch('https://sandbox-gateway.mara.boo/api-access/calculators/swap', {

method: 'POST',

headers: { /* auth headers */ },

body: JSON.stringify({

amount: 50000,

from_currency: 'xof',

to_currency: 'cad',

country: 'bf'

})

});

const { quote_id } = await swapQuote.json();

// 2. Execute swap

const swapResponse = await fetch('https://sandbox-gateway.mara.boo/api-access/transactions/client/sessions/swap', {

method: 'POST',

headers: {

'Authorization': 'HMAC-SHA256 YOUR_PUBLIC_KEY:YOUR_PRIVATE_KEY',

'X-Origin': 'third-party-api.mara.boo',

'X-Timestamp': new Date().toISOString(),

'X-Idempotency-Key': `swap-${Date.now()}-${quote_id}`,

'Content-Type': 'application/json'

},

body: JSON.stringify({

swap_quote_id: quote_id,

source_wallet: 'wallet-xof-456',

destination_wallet: 'wallet-cad-789',

transaction: {

amount: 50000,

from_currency: 'xof',

to_currency: 'cad',

country: 'bf',

payment_channel: 'bank_transfer'

},

session_type: 'swap_transaction',

swap_type: 'SWAP'

})

});Tracking Transactions

Get Transaction Status

Retrieve specific transaction details:

GET /api-access/transactions/client/sessions/{session_id}List All Transactions

Filter and retrieve transaction history:

GET /api-access/transactions/client/sessions?limit=20&status=completedAvailable filters:

status: Filter by transaction statusstart_date/end_date: Date rangerecipient_id: Filter by recipienttype: Transaction typecurrency: Filter by currencywallet: Filter by wallet ID

Payment Channels

Maraboo supports multiple payment channels across different regions:

West Africa (WAEMU) - XOF

Payout Channels:

mobile_money: MTN, Moov, Orange Moneydirect_deposit: Direct bank depositsxpresscash: Cash pickupcredit_ecobank_account: Ecobank account creditsbillpay: Bill payment services

Payin Channels:

bank_transfer: Bank transfersdirect_debit: Direct debit payments

Countries: Benin (BJ), Burkina Faso (BF), Côte d'Ivoire (CI), Guinea-Bissau (GW), Mali (ML), Niger (NE), Senegal (SN), Togo (TG)

North America - CAD

Canada Channels:

interac_send: Interac Send (payout)interac_request: Interac Request (payin)eft: Electronic Funds Transferbillpay: Bill payment

North America - USD

United States Channels (Coming Soon):

swift: SWIFT transfersfednow: FedNow instant paymentsbank_transfer_ach: ACH bank transfers

Recipients

Before making payments, you can pre-create recipients or provide recipient details inline:

Pre-create Recipients

POST /api-access/recipientsBenefits:

- Reuse recipient information

- Faster transaction creation

- Recipient validation upfront

Inline Recipients

Provide recipient details directly in payment requests. Useful for one-time payments.

Best Practices

1. Always Get Quotes First

Use calculator endpoints before transactions to ensure accurate fees and exchange rates.

2. Store Quote IDs

Quote IDs help track pricing and provide audit trails.

3. Handle Webhooks

Set up webhooks to receive real-time transaction status updates instead of polling.

4. Implement Idempotency

Use Idempotency-Key headers to prevent duplicate transactions.

5. Validate Recipients

Use the account enquiry endpoint to validate recipient details before large transfers.

6. Monitor Transaction Status

Track transactions through completion and handle failures gracefully with retry logic.

Error Handling

Common payment errors and solutions:

| Error | Cause | Solution |

|---|---|---|

400 Bad Request | Invalid parameters | Validate all required fields |

401 Unauthorized | Invalid authentication | Check API credentials |

422 Validation Error | Field validation failed | Review field requirements |

insufficient_funds | Wallet balance too low | Fund wallet before payment |

invalid_recipient | Recipient details incorrect | Validate recipient information |